Does Volatility Affect Your Profits in Binary Option Trading

An in Depth Look at Volatility in Binary Options

Do you know there are other option models available for trading besides binary options? Most of them were present even before binary options were made public. So what has made binary (digital) options so popular? One of the reasons is that volatility does not affect binary option trading in the same it does, for example, vanilla options.

How binary options are immune to effects of volatility?

The pricing mechanism of binary option trading is different than the one used for vanilla options. Vanilla option pricing is based upon Black Scholes model, which takes into account the intrinsic price of asset, strike price, interest rates and volatility. Market volatility is a major controlling impetus and the price of vanilla options is directly proportional to it – higher the volatility, higher becomes the price. On the contrary, binary options pricing are not directly linked with volatility, which makes their prices, to an extent, independent of its effects.

How binary options are not directly linked with implied volatility?

The most unique feature of binary option trading is that its payout is fixed. It does not depend upon other factors such as the difference between underlying asset price and the strike price (known as spread). For example, if the payout is $1 for a call option with $10 strike price, it will still be the same $1 payout even if the price of the asset ends up at $20! This means the value of the option will not get higher regardless of the price hike occurring in the asset. It can be stated that binary options are priced very similarly to bull call spreads. Analyzing the bull call spread will be a good way to understand how binary options are immune to volatility.

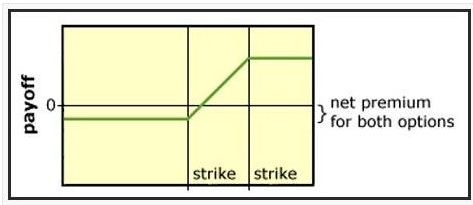

Bull call spread: Like binary option trading, the payout on a call option with bull spread is also fixed. It is a trading practice in which the trader buys a low priced option and sells a high priced option simultaneously.

Example: A trader purchases an XYZ stock with a strike price of $10 and sells a call option (from the same stock) worth $10.10 at the very moment. When stock price becomes $10.50 or $11, the payout still remains the same at 10 cents ($10.10 - $10).

The graph below shows the way bull call spread will pay off.

The payout remains zero until the market touches the first strike price (relative to the low priced option), it then starts to increase until it reaches the second strike price (relative to the high priced option) and then levels off. The trader will need to pay some extra amount to buy this option structure, as the price for low priced option will be slightly higher than the high priced option, but he will receive a premium for high priced option much greater than the premium he will need to pay for the low priced option. The implied volatility and the risks involved with the purchase of low priced price option will be offset by those of the high priced option.

As stated earlier, the binary options have the same structure as the bull call spread, which makes them ideal to trade when the market experiences high volatility.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips