Daily Market Review - 1/16/2014

US Stock Market

US indices finished the trading day in the green after the World Bank raised the global growth forecast. The Dow Jones rose by 0.66%, the S&P500 by 0.52%, and the NASDAQ added 0.82% to its value. Technically, and according to the 4-hour chart, the S&P 500 is trading above the strong support level of 1,839; a figure that represents a new record high. Maintaining this support will lead the index towards 1,850 and even higher should the economy continue to grow. However, dropping below this support level may send the price back to 1,810. The MACD indicator supports the bullish trend.

Gold

Gold fell by 0.19% closing at $1,240 an ounce. Technically, and according to 4-hour chart, gold has strong support at $1,232. As long as the price holds, gold may hit resistance at $1,250. Should it fail to breach resistance and crosses below the support level, the price may drop to around $1,200. The Momentum Indicator points to a retreat on gold that may push the price higher.

Euro (EUR)

The Euro fell against the U.S Dollar as the European Trade Balance came out worse than expected at 16.08B vs. 16.7B forecast. As we see on the 1-hour chart, the EUR/USD has fallen towards the support level of 1.3588 and failed to cross below it. If the pair manages to hold above this level it may rise towards 1.3660 again. Also, the EUR/USD's support level is strong enough to be reachable, a possibility also supported by the Moving Average indicator that is pointing to a positive momentum. Today, The Consumer Price Index report is expected unchanged at 0.8%.

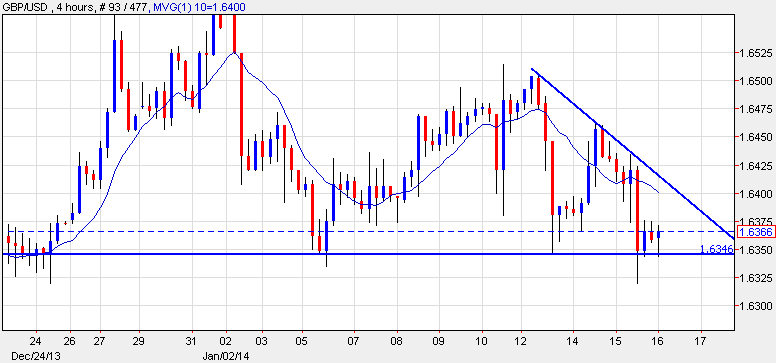

British Pound (GBP)

The Pound fell against the US Dollar yesterday. Technically, and according to 4-hour chart, we notice that the GBP/USD has created a Descending Triangle pattern with support at 1.6346 and resistance at 1.6430. Currently, the pair is showing a positive momentum with a strong support level which could push the price higher. But if the GBP/USD fails to breach resistance it may complete the bullish triangle by falling to around 1.6300.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips