Daily Market Review - 1/24/2014

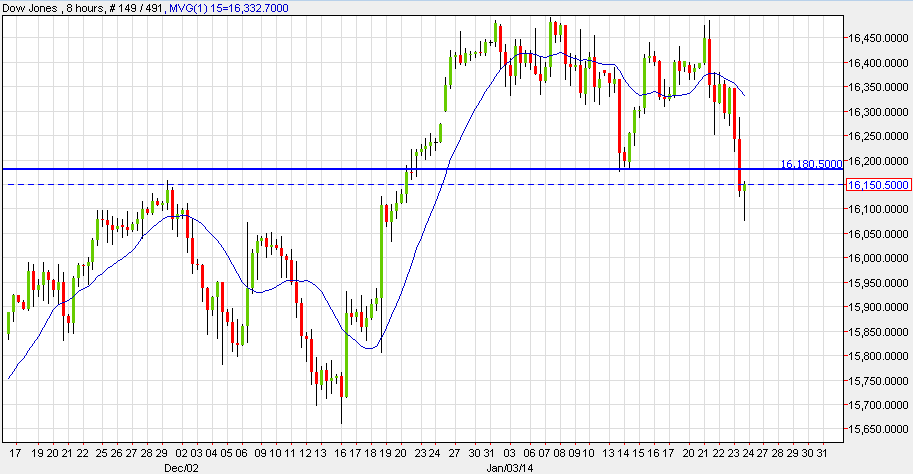

US Stock Market

A disappointing Existing Home Sales report drove US stocks down Thursday. The Dow Jones lost 1.07% from its value, the NASDAQ fell by 0.38%, and the S&P 500 by 0.89%. Technically, and according to the 8-hour chart, the Dow Jones has broken below the strong support level of 16,180 and the trend has turned bearish. A further fall to around 16,000 is more than likely.

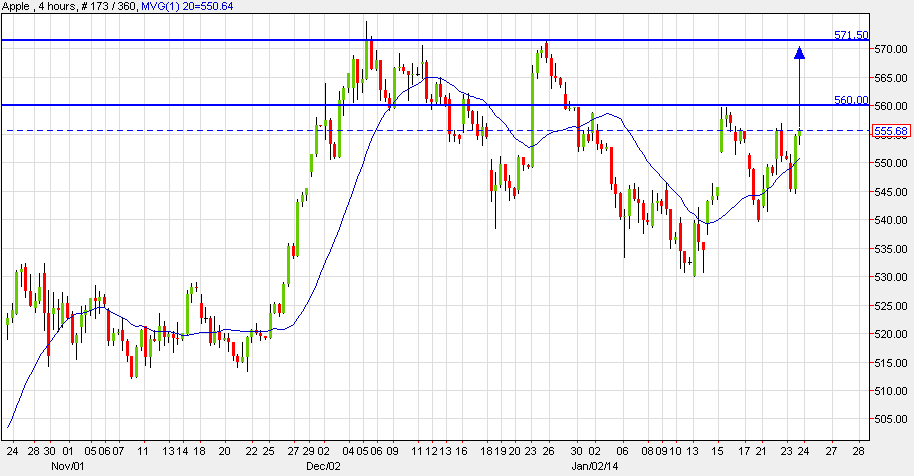

Apple

Apple shares rose by 0.85%, closing at $556.18 after billionaire investor Carl Icahn said that he had bought a further $500M of Apple shares. Technically, and according to the 4-hour chart, Apple is trading close to the strong resistance level of 560. Should the share price succeed in breaching this level, it will likely form a new resistance level at around 571.

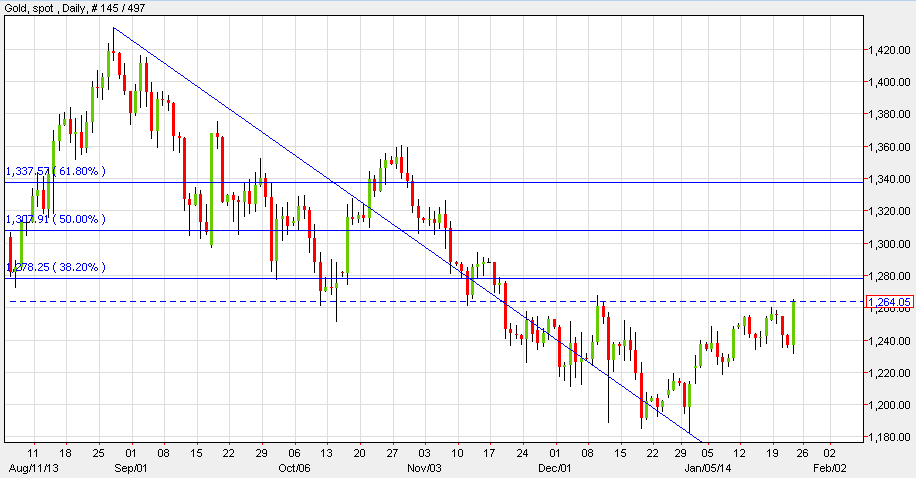

Gold

Gold added 2.22% to its value, closing at $1,264 an ounce after investors sought shelter for their investments in the precious metal. Technically, and according to the daily chart, gold is now trading in a bearish momentum. As long as the price remains below the 1,280 resistance level, which also marks the 38.20% Fibonacci Retracement level, gold may continue climbing to around 1,310.

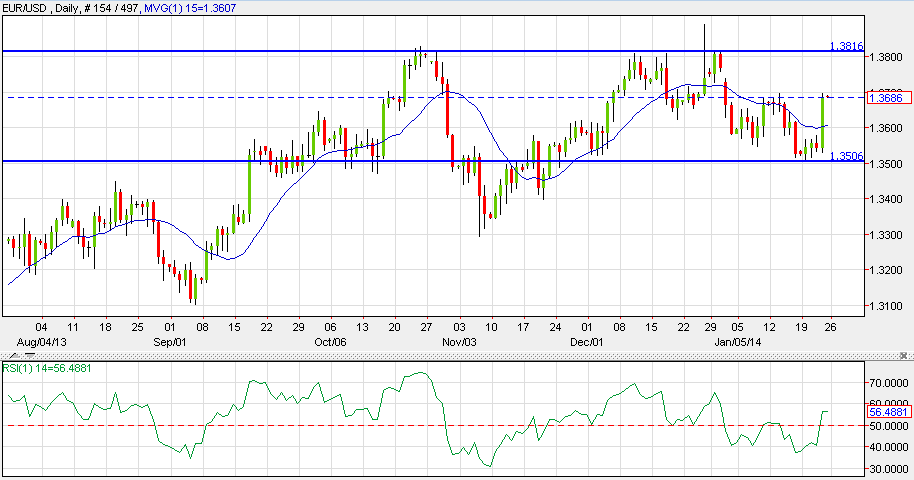

Euro (EUR)

The euro rose versus the US Dollar after the German Flash Manufacturing PMI report came out better than expected at 56.3 vs. 54.7 forecast. Technically, and according to the daily chart, the EUR/USD is trading with a bullish momentum in a channel between the support level of 1.3500 and the resistance level of 1.3810. Both the RSI and Moving Average indicators also support the bullish trend.

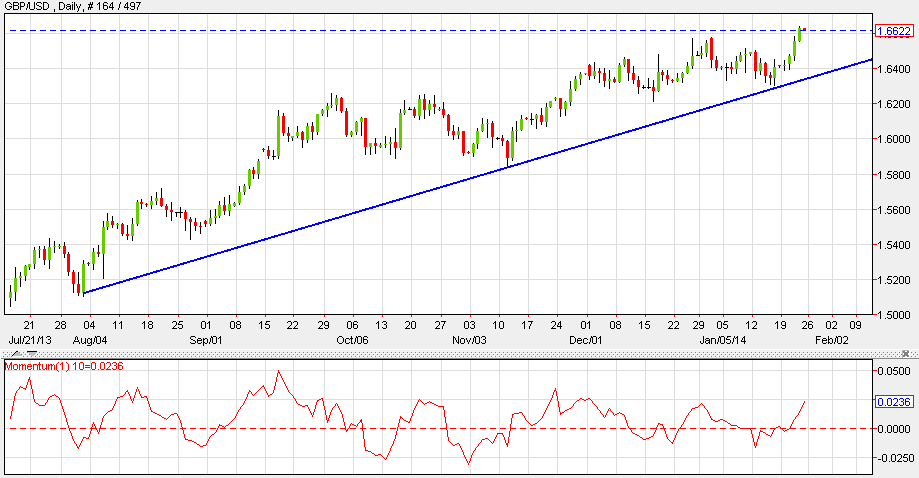

British Pound (GBP)

The Pound rose versus the US Dollar to reach its highest level since May 2011 amid growing speculation that the Bank Of England will increase the interest rate earlier than forecast due to a stronger than expected economic recovery. Technically, and according to the daily chart, the GBP/USD is trading in an ascending trend line, and the pair may rise to around 1.6800. The Momentum Indicator also fully supports the bullish trend.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips