Daily market Review - 1/27/2014

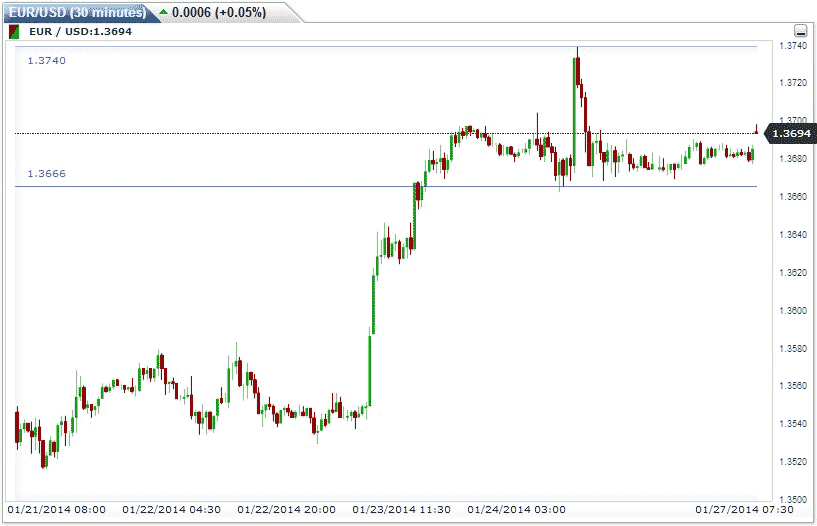

Euro (EUR)

After recent rally and subsequent retracement (correction of the bullish trend) the pair continues to consolidate. Support is at 1.3660. If it holds, we are likely to see a resumption of the prior trend.

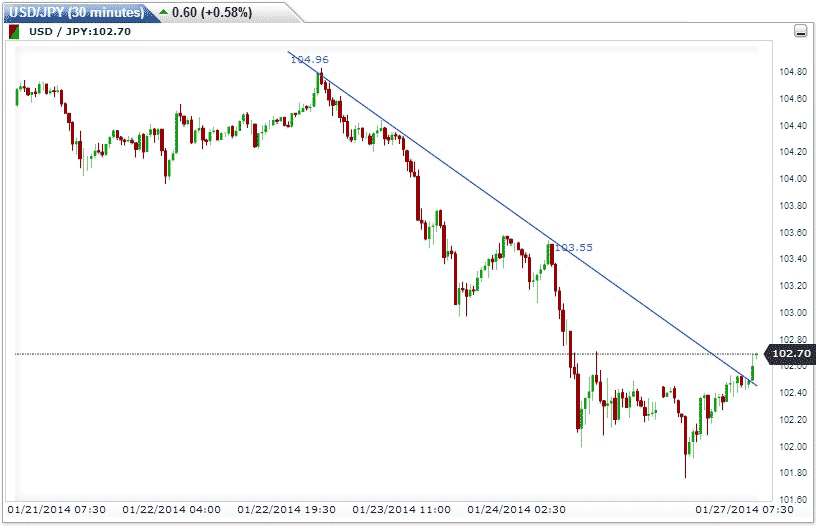

USD/JPY

Overall outlook for the pair is bearish. However the near term bias is bullish. If it turns into decisive break above the trend line, then we are going to see a trend reversal. Otherwise it will be followed by a rebound down.

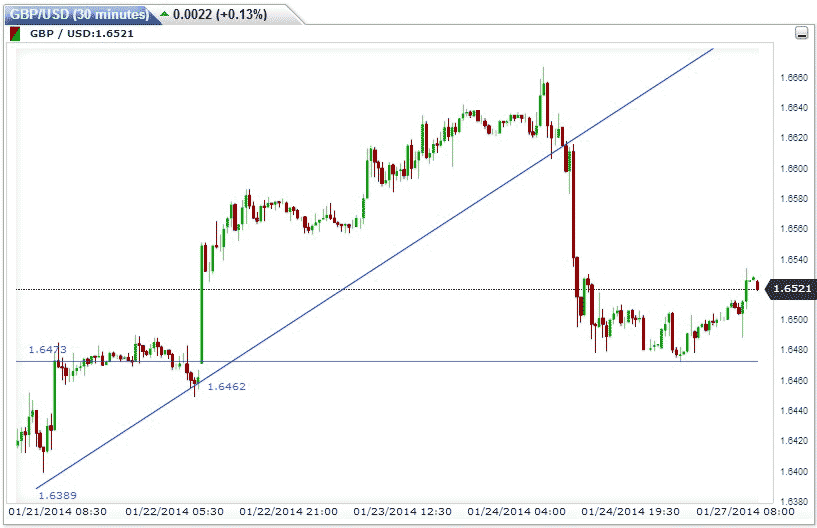

British Pound (GBP)

The Pound is consolidating after upward trend correction. After breaking below the up slanting trend line it dipped until it found support at 1.6473. At the moment further trend remains uncertain.

Market Overview

By results of last week American currency weakened against its main counterparts. In the first half of the week the European currency was under pressure against the background of weak data on ZEW index. Bears tried hard, but their attempts to push didn't succeed. On Thursday we saw an abrupt rally of the Euro up to the level of 1.3697 after publication of positive reports on PMI index in manufacturing sector of Germany and France. Nevertheless, investors reacted too emotionally on publication of PMI releases, and at the last trading day after a short growth of EU currency we saw profit fixation on long positions, and the trading week ended at 1.3677.

British currency has strengthened against the US currency following the Euro pattern. Wednesday was the biggest strike for the Pound. At that day protocols of the BoE were issued along with report on the labor market. Unemployment in November declined to 7.1%, what suggests the recovery of the labor market in the UK. The Pound has appreciated against such positive background, overcoming few resistance levels at once.

On Thursday growth continued and a fresh maximum of 2 years was set. But British regulator has mentioned in protocols of the last meeting, that there had been no necessity to increase interest rates after reaching the 7% goal level of unemployment.

The main event of the coming week will most likely be Wednesday. The FRS is going to determine the direction of the currencies’ market. To be more specific on January 29th there will be a FOMC statement. Analysts foretaste the impact of the announcement, which is going to shape current trading week.

Economic Content Calendar

|

All Day |

Holiday |

Australia - Australia Day |

|

09:00 |

EUR |

German Business Expectations |

|

09:00 |

EUR |

German Current Assessment |

|

09:00 |

EUR |

German Ifo Business Climate Index |

|

15:00 |

USD |

New Home Sales |

|

15:00 |

USD |

New Home Sales (MoM) |

|

18:00 |

EUR |

German Buba President Weidmann Speaks |

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips