Daily market Review - 1/8/2014

Technical Overview

US Stock Market

Wall Street finished the trading day with few gains on hopes that better than expected U.S. macro-economic data due out Friday will take major indexes higher. The S&P 500 gained 0.96%, the NASDAQ rose by 0.96%, and the Dow Jones added 0.64% to its value. Google also rose by 1.93% to close at $1,138. Technically, according to the 1-hour chart, the Dow Jones has completed the expected Double Bottom pattern and reached the 16,480 resistance level. We also notice a strong Bullish Flag pattern and the index is expected to keep its positive momentum towards 16,500 areas.

Australian Dollar (AUD)

The Australian Dollar fell versus the U.S Dollar after an industry survey showed a drop in construction activity in December. In addition, the Trade Balance turned out better than expected at -0.12B vs. -0.30B. Technically, according to the 8-hour chart, the AUD/USD is moving in a Descending Channel. Currently, the pair is at the top of this channel and is expected to start falling towards 0.8820 areas. Today, the Building Approvals report is expected at -0.90% vs. -1.80% previously and the Retail Sales report unchanged at 0.50%.

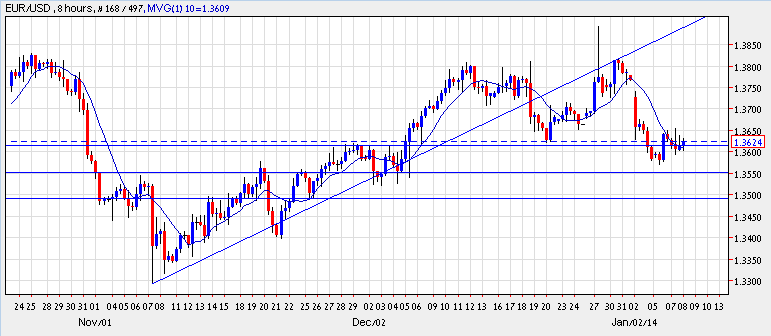

Euro (EUR)

The Euro fell slightly versus the US Dollar as investors await the European Central Bank's upcoming policy statement on Thursday. In addition, the CPI Flash Estimate came out worse than expected at 0.80% vs. 0.90%. Technically, according to the 8-hour chart using Fibonacci Retracement, the EUR/USD has reached the second level and the trend is set to remain bullish as long as the pair maintains this support level of 1.3570. Breaking resistance at 1.3650 could lead the pair towards 1.3740 areas. The Moving Average 50 level supports the bullish trend as well. Today, the Retail Sales report is expected at 0.20% vs. -0.20% previously and the Unemployment Rate unchanged at 12.10%.

Gold

Gold fell by 0.69% on Monday closing at $1228 an ounce. Technically, according to the 8-hour chart, gold has completed last week's "W" pattern and is holding below the critical resistance level of $1,245. Should gold breach resistance, it could jump to around $1,265. However, should the pair fall below the support level of $1,225, it may drop to the next support level at $1,200.

Market Overview

The U.S markets as well as their peers from Europe soar on Tuesday after mounted expectations for an additional stimulus measures by the European Central Bank as well as upbeat data from the U.S which lifted markets sentiment.

Before the bell yesterday, the Commerce Department enounced that the U.S. trade deficit narrowed to USD34.25 billion in November from a revised deficit of USD39.33 billion in the previous month.

Economists were expecting the U.S. trade deficit to widen to USD40 billion.

I additional report, U.S. exports rose 0.9% to a record high of USD194.9 billion, while imports fell 1.4% to USD229.1 billion.

This latest data on Tuesday, led to an increase hopes that the December jobs report due for release on Friday will come in-line or even above expectations.

At the close of U.S. trading yesterday, the Dow Jones Industrial Average rose 0.64%, the S&P 500 index rose 0.61%, while the Nasdaq Composite index rose 0.96%.

Asian stocks closed Wednesday session mixed while the markets tried to break out from its losing streak that started at the beginning of the year last week. Since the economic calendar was pretty much empty, the positive closing yesterday in the U.S did help the overall sentiment.

The Nikkei 225 jumped 1.94%, the Hang Seng index rose 1.19%, while Shanghai Composite index fell 0.21%.

The European exchanges are expected to remain flat until the publication of the Euro-zone Retails sales and Unemployment rate.

The private-sector jobs growth report (ADP) and the minutes of the Federal Reserve's December policy meeting are expected at 13:15GMT and at 19:00GMT respectably.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips