Forex Channel Trading System

Forex Channel Trading System

Submitted by adil on Mon, 01/20/2014 - 09:37

Tagged as: Forex Trading , Forex Trading

One of the easiest to implement Forex Swing Trading Systems is Forex channel trading system. If you successfully manage to learn how to draw these channels accurately, you can make really good profits without doing much of the effort.

Definition of a Trading Channel:

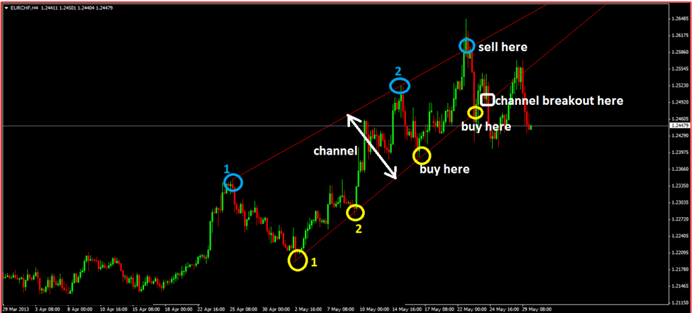

Most often, the price in a Forex chart runs between the support and resistance levels (a channel) and this condition is normally called as the Trading Channel. Once in the channel, the price sways in the channel till the channel breakdowns. Following figure is an example of price in a downward trading channel.

Similarly, the price in upward channel will create a totally reverse chart. Take a look at the following figure.

How to Draw a Channel:

Now the question is how to draw an accurate trading channel. Following points explain how to do so.

- You start by locating the points where you want to create or draw the trading channel. Then number them 1 and 2 accordingly as shown in the above chart.

- You need to identify minimum of two points to draw a channel.

- Finally, draw a trend line to connect these two points with each other.

How to Trade Using a Trend Channel:

Now how do you trade using the trend channel you have just drawn? This is also very easy and following points describe how.

- As you can see, there are two trend lines on either side of channel drawn by connecting two points with each other. First of all, you simply wait for the price to touch any of these lines.

- The rest is very straight forward. Depending upon which side of channel the price is touching the lines, you place a trade as soon as the price reaches the line. For instance, you sell if the price touches the line above or buy if price touches the line below. The above charts will clear the situation more clearly.

Types of Orders to Use in Trading Channel:

In this regard, you can use both Sell and Buy Stop orders. Similarly, you can also take help of Instant Market Orders. Instant market orders mean you will place a buy or sell order as soon as the price touches the channel lines.

How to Place Stop Losses in Trading Channels:

You just need to place your stops outside the trading line. Similarly, the time frame during which you trade should determine by how many pips you should place the stop loss. For instance, it is a better idea to place your stop loss 10-15 pips outside the channel if you are trading on 5 minute chart. Simply increase number of pips accordingly if your trade for longer charts. Avoid placing pips too close to channel lines as it can result in you getting out of the trade all together regardless of direction of price.

How to Set Profit Targets:

You can use different options to set your profits with trading channels such as,

- The pips’ length in the channel can determine your profit target.

- Similarly, the halfway point of the channel can also set your profit target.

- Similarly, when price reaches halfway in the channel, you can take half of your profit.

Finally, you can take 3 times the profit than the price risked by you.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips