Trading Patterns Based on Price Movements

Trading Patterns Based on Price Movements

Submitted by adil on Thu, 06/26/2014 - 17:30

Tagged as: Forex Trading , Forex Trading

Learn to Trade Based on Price Movement

The three best strategies for FOREX trading that are based on price action and involve using the candlestick charts are pin bars, inside bars and Fakeys. With education, discipline, dedication, and patience you can prove to be one of the most successful FOREX traders equipped with the following strategies.

Strategy based on Pin Bars

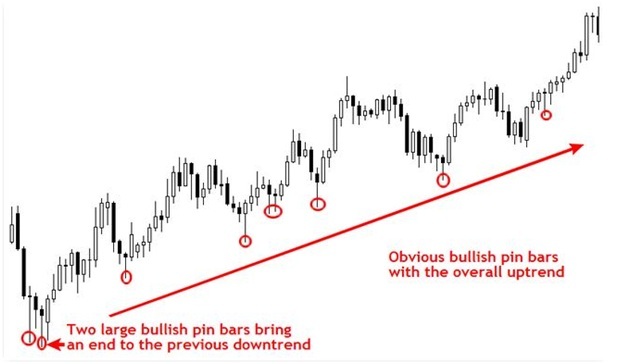

Pin bars are one of the most accurate setups in a trending market when appearing at regular basis in the chart. If the pin bars occur at strategic support and resistance levels, the market trend can be predicted very precisely. They are also very good indicators of reversal patterns, in-case they give a well-defined impression with longer protrusions than the neighboring price bars.

The following chart describes how the pin bars help in accurately determining the price movements in a trending market. Note how the two bullish pin bars at the extreme left depict a strong trend reversal.

Strategy based on Fakey formation:

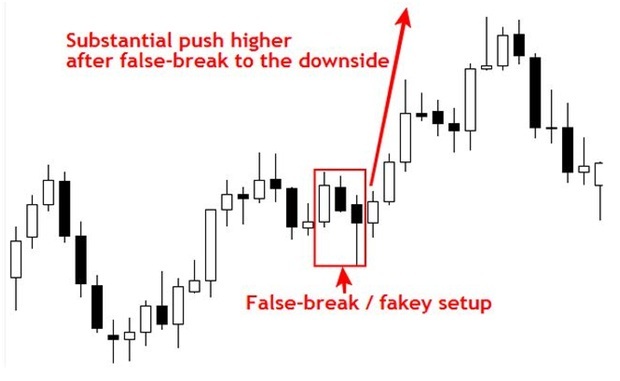

This is the setup, identification and utilization of which separates a professional FOREX trader from an amateur. Sometimes the market is moving in one direction and all traders start following the trend, and then the price movement abruptly reverses, proving disastrous to inexperienced traders while the professional traders pocket loads of profits.

Look at the arrangement of candles in the image above, the first bar is succeeded by the inside bar, the third is the false break followed by a close back. The bullish Fakey point that signifies entry is the last candle which breaks from the high of the inside bar (breaking of low of inside bar will occur in-case of bearish Fakey).

In the image below, the false break encouraged amateur traders to move towards selling trying to take advantage of market top, the professionals flushed all such traders with a buying spree.

Inside bars:

The inside bars can be used as either a signal of continuation or as an indicator of trend reversal point. If inside bars are new to you, it is advised to limit yourself to use these bars as a continuation signal. The image above shows two bars, the second of which is the inside bar, completely in range of the previous bar.

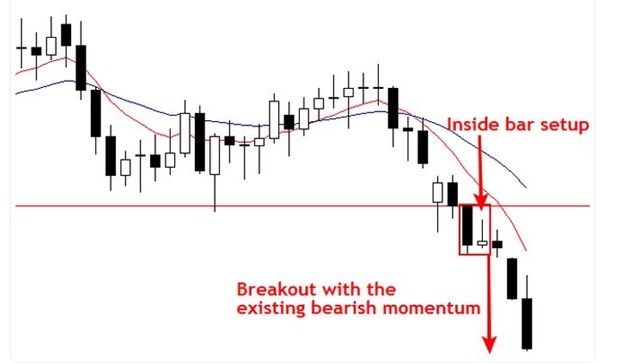

The inside bar signifies the price movements experiencing short term consolidation before breaking out by following the overall market trend. Trading with strategy based on inside bars should be done with daily or weekly charts. You can minimize the risks while making big profits with each trade.

The example below is the chart of EUR/USD price trend that has readily broke down powered by bearish momentum. You can easily notice that the breakdown at the support level is preceded by an inside bar setup which is certainly identifiable.

All the above three trading strategies signify the fact that FOREX trading is not difficult to master. You just need to be able to identify specific formations occurring at important points in the price trend and make trades accordingly. The trader who strives to work hard with patience and discipline will truly achieve success with FOREX trading.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips