Understanding ECN Order Flow Trading

Understanding ECN Order Flow Trading

Submitted by adil on Mon, 12/30/2013 - 15:03

Tagged as: Binary Options Trading , Binary Options

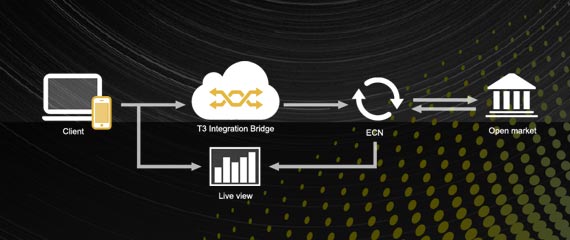

Nowadays, it is common among experts to debate on the suitability of Electronic Communication Network (ECN) against the traditional market strategies. This debate between the exponents of both methods generally concentrates on many issues and some most important of them are given below.

- The minimum deposit required that is higher with the ECN.

- Commissions (also higher with ECN).

- Spreads (Lower with ECN).

- The speed of execution. The ECN offers faster executions at reasonable prices.

- What is the exposure to account losses? These losses are greater with ECN.

- Slippages (also greater with ECN).

Traders before opening a new account should take all of the abovementioned points into consideration before making a final decision of which method to use before closely monitoring any particular trader himself. Some experts also recommend considering the trading style of any trader as a determinant in your choice. However, it is not necessary apart from two exceptions.

Firstly, order flow traders can obtain necessary information to make their trading decisions only from platforms of ECN brokers and therefore, they are bound to use ECN broker only. Secondly, scalpers tend to feel comfortable with ECN brokers simply because most market brokers look out for and disallow trading with ECN.

The Order Flow Trading:

Simple theories form the basis of Order Flow Trading. The price is moved by only one thing that is whether there are more sells or buys in the market at a particular point. For instance, if you observe a cluster of sell and buy orders placed at certain price levels, you can place the similar order close or at the same levels of price. As a result, the momentum generated by the crowd will help you to trade successfully and profitably.

Other trading techniques such as candlestick analyses and price action use the same trading idea. What they simply do is to divine the footprints of order flow from trading charts. However, the Order Flow Trading has the ability to take things lot further.

Working of Order Flow Trading:

Almost all the top traders in the market are currently using ECN trading. In quite contrast to traditional market trading that only displays bids and asks for prices, ECN traders can also monitor limit and stop orders and execute them on the right time in their favour. In fact, they can properly analyse market depth because they cannot only see the size of stop orders but can also see their prices on which they are intended to be executed.

You also need to remember that nothing can stop traders from placing order at some distance from current price and before the trade is executed, pull the order out of the market. A smart order flow trader might make profitable trade when price is at 90 but it is mandatory for upward trend to run out of stream. Furthermore, he will place a big sell order at 100 much higher than his own position just because he wants to drive the upward move bit further.

This trend encourages other traders to buy it as they expect to get huge profitable sell orders filled at 100. As a result, price will rise but the trader who has placed big sell order at 100 is slowly selling his position through this buying. He would have sold out all his position at relatively higher prices till the time price hits 99. He will finally accomplish his mission by quickly removing his big sell order at 100.

Order flow traders play games within games quite profitably and this is only one simple example. Therefore, a new opportunity might be beckoning for you if you are willing to embrace ECN.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips