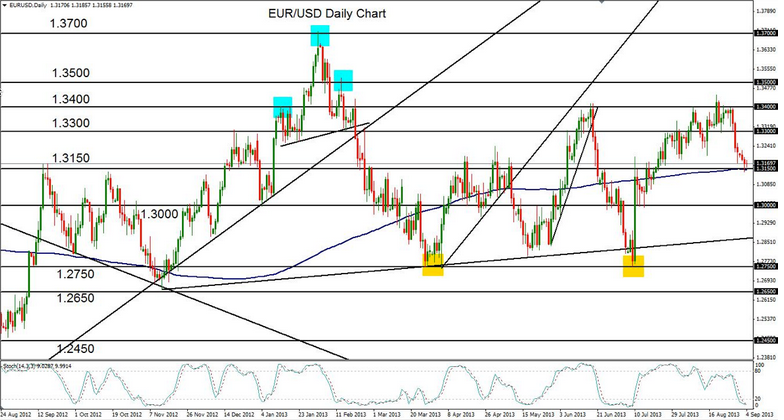

EUR/USD weekly outlook: September 23 - 27

Investing.com – The euro was steady close to eight-month highs against the dollar on Friday after St. Louis Federal Reserve President James Bullard indicated that the U.S. central bank could start to taper its stimulus program in October.

EUR/USD settled at 1.3523 on Friday, dipping 0.05% for the day after rising as high as 1.3567 on Thursday, the highest since February 7. On the week, the pair was 1.4% higher.

The pair is likely to find support at 1.3475 and resistance at 1.3567, Thursday’s high.

The greenback found support after St. Louis Fed President James Bullard said the decision not to taper in September was “close” and did not rule out a small reduction in the central bank's bond purchases in October.

The comments came during an interview with Bloomberg television.

Forex - Dollar drops as Fed leaves stimulus program unchanged

Investing.com – The dollar plummeted against most major currencies on Wednesday after the Federal Reserve said it was making no changes to its USD85 billion monthly bond-buying program.

Many investors were expecting the U.S. central bank to trim the amount of bonds it purchases a month at least by USD10 billion.

In U.S. trading on Wednesday, EUR/USD was up 1.07% at 1.3501.

The Federal Reserve on Wednesday left its key benchmark lending target, the fed funds rate, unchanged at 0.25% and kept its USD85 billion monthly asset-purchasing program in place.

The Fed said the economy was showing signs of improvement though it still faced enough headwinds to prompt monetary authorities to hold off on tapering its asset purchases, which weaken the dollar to spur recovery.

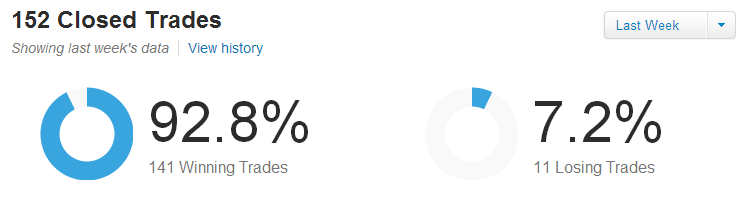

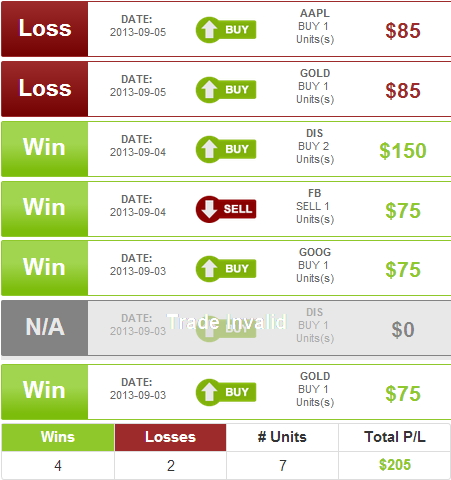

Last week was another profitable week for our Expert alerts, pulling in an awesome 90% for those that followed all of our Daily and GOLD alerts! With our 8 trade alerts, 5 were winners for a 63% winning percentage. Check out our alerts for yourself:

.jpg)

If you aren't a GOLD member, don't miss out on these profits any more!

.jpg)

.png)

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips