OptionBit provides the quickest, easiest and inexpensive way to trade the markets! You simply choose an asset, select a time frame and decide if the asset's price will go up or down, and if you're correct, cash in on profits up to 80%. We are so confident that you will love trading at OptionBit we are going to offer you an unbeatable deal to try it out.

Deposit at OptionBit and receive:

- Risk Free Trading up to 0 -Trade our Expert Alerts at OptionBit and we'll refund you if you lose up to 0!

- 50% First Deposit Bonus for IntelliTraders! - IntelliTraders receive a 50% First Deposit Bonus with OptionBit. Must ask their support.

- Promotion of the Month: 3 Months Free ExpertsThis month, we are offering 3 months free Experts access for those who deposit a minimum 0 into a trading room they are currently not a member of.

Learn more about OptionBit at our Broker Review Page, but here is an executive summary for you:

OptionBit Summary

Deposit Options:

Visa, MasterCard, Bank Wire, CashU, Neteller, Reuters

Minimum Deposit: 0

Maximum Deposit: 000+

Deposit Bonus: 100% up to 5

|

Dollar mostly higher as traders react to shutdown

Investing.com – The U.S. dollar traded higher against most of its major rivals during Wednesday’s Asian session as traders remained concerned about the impact a U.S. government shutdown could have on riskier currencies.

In Asian trading Wednesday, EUR/USD fell 0.12% to 1.3510 after data out Tuesday showed that the final reading of the bloc’s manufacturing index came in at 51.1 in September, unchanged from the preliminary estimate, but below 26-month high of 51.4 in August.

Separately, Eurostat reported that the euro zone's unemployment rate hit 12.0% last month, while the August rate was revised down to 12.0% from 12.1%. Analysts were expecting a 12.1% September unemployment rate, which gave the single currency support.

USD/JPY dropped 0.09% to 97.94 after the Bank of Japan said Japan’s monetary base rose to 46.1% lat month from 42% in August. Analysts expected a September reading of 45.3%.

Dollar softens but trims losses on U.S. government shutdown woes

Investing.com – The dollar softened against most major currencies on Monday though it trimmed earlier losses as investors continued to avoid the currency on fears that Congress will fail to pass a spending package and avoid a government shutdown.

In U.S. trading on Friday, EUR/USD was up 0.01% at 1.3523.

The U.S. Congress must approve a spending package by the end of the day to avoid a government shutdown, and waning faith for a last-minute deal steered investors away from the dollar and into other safe-haven assets such as the yen earlier.

Congressional Republicans and Democrats continued to spar over President Barack Obama's healthcare law, a bargaining chip to fund a spending package to keep the government running.

Republicans oppose the president's healthcare reform and want it delayed in exchange for approving a spending deal, something the Democratically controlled Senate rejected on Monday afternoon.

Gold falls as U.S. jobless claims report sparks talk of Fed tapering

Investing.com – Gold prices fell on Thursday after better-than-expected data out of the U.S. labor market rekindled expectations for the Federal Reserve to begin tapering the pace of its USD85 billion in monthly asset purchases, which weaken the dollar to spur recovery.

Gold and the dollar tend to trade inversely with one another.

On the Comex division of the New York Mercantile Exchange, gold futures for December delivery traded at USD1,324.70 during U.S. afternoon hours, down 0.86%.

Gold prices hit a session low of USD1,319.40 a troy ounce and high of USD1,339.60 a troy ounce.

Gold futures were likely to find support at USD1,306.20 a troy ounce, Tuesday's low, and resistance at USD1,375.10, last Thursday's high.

The December contract settled up 1.51% at USD1,336.20 a troy ounce on Wednesday.

Crude prices fall as report reveals U.S. oil supplies are on rise

Investing.com – Crude oil futures fell on Wednesday after official data revealed that U.S. inventories rose last week and caught many investors who were predicting a decline off guard.

On the New York Mercantile Exchange, light sweet crude futures for delivery in November traded at USD102.55 a barrel during U.S. trading, down 0.56%.

The November contract settled down 0.44% at USD103.13 a barrel on Tuesday.

The commodity hit a session low of USD102.51 and a high of USD103.96.

The Energy Information Administration said that crude oil stockpiles rose by 2.64 million barrels in the week ending Sept. 20, defying expectations for a 1.13 million decline after a 4.37 million barrel drop in the previous week.

Gasoline inventories rose by 217,000 barrels last week, exceeding expectations for a 143,000 rise.

The data sent oil prices falling on concerns the U.S. is awash in crude.

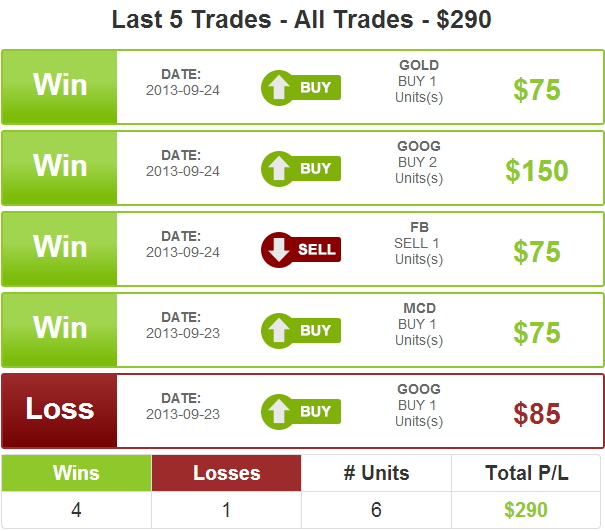

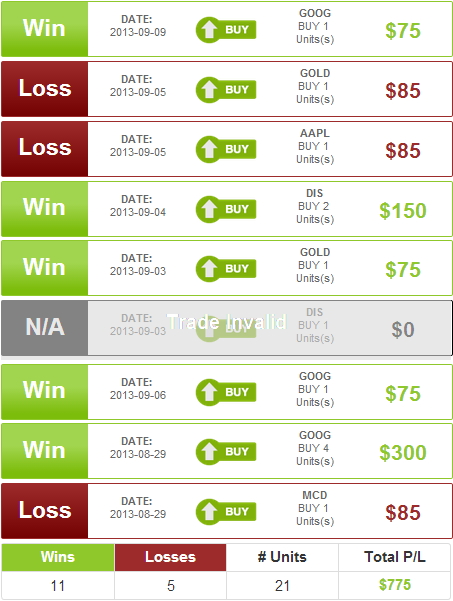

There's no other way to put it: our Expert Trade Alerts are on FIRE. This week alone, we are a sizzling 4-1 on alerts, for an 80% winning percentage, and a postive 290% in returns. You're not going to beat that anywhere else, so quit messing around.

If you aren't a GOLD member, don't miss out on these profits any more!

.jpg)

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips