Dollar firms on U.S. industrial output data, eyes Fed meeting

Investing.com – The dollar rose against most major currencies on Monday after industrial production data beat expectations though gains were limited as investors remained camped on the sidelines to await the Federal Reserve's decision on monetary policy on Wednesday.

In U.S. trading on Monday, EUR/USD was up 0.01% at 1.3807.

The Federal Reserve reported on Monday that U.S. industrial production rose by a 0.6% last month, above expectations for a 0.4% rise and the fastest increase in seven months.

The news gave the dollar some support, though investors remained cautious ahead of the Fed's upcoming two-day policy meeting that opens on Tuesday.

A string of disappointing economic reports has cemented expectations that the central bank will maintain the current pace of its USD85 billion in monthly asset purchases into early next year.

Asset purchases aim to spur recovery by driving down long-term borrowing costs, weakening the dollar in the process.

Still, the upbeat industrial output number gave investors some hope that sooner or later, the Fed will begin to taper the pace of its stimulus program, which would give the dollar support afterwards.

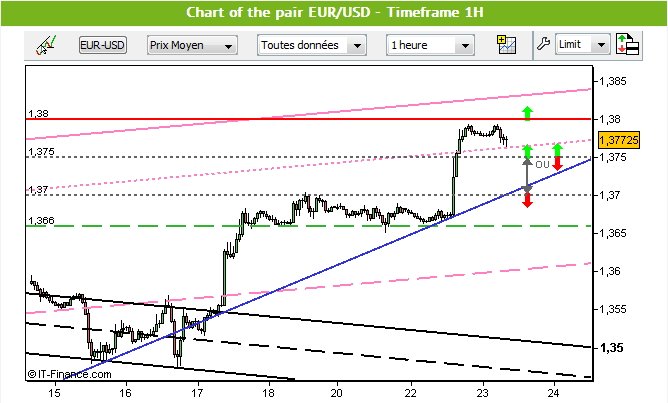

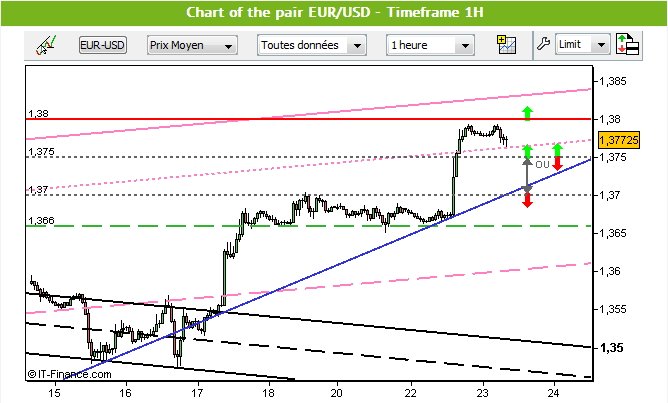

The pair EUR/USD started yesterday a powerful bullish rally.

The price has validated the upward breaks of 1.37 nad 1.3750, offering new buy signals.

The EUR/USD is back on the upper bands of its medium term bullish channel (pink lines).

A double top has been made on the major resistance at 1.38.

The upward movement is led by a bullish slant (blue line on the 1H chart).

I would advise traders to trade only Long positions (buy) as far as the price is above 1.3750.

A break of 1.38 will offer a new buy signal for an extension of the rally towards 1.3850.

In case of return below 1.3750, we will then advise to wait a breakout of 1.37 before to trade short positions (sell).

NB : traders whose trading strategy is more aggressive could trade the EUR/USD according to 1.3750 (long above ; Short below).

U.S. stocks end lower on profit taking, mixed earnings; Dow dips 0.35%

Investing.com – U.S. stocks fell on Wednesday after investors locked in gains from Tuesday's rally and sold for profits on concerns that despite bullish monetary forces supporting stocks, other fundamentals may be facing headwinds.

At the close of U.S. trading, the Dow Jones Industrial Average finished down 0.35%, the S&P 500 index fell 0.47%, while the Nasdaq Composite index fell 0.57%.

Stocks rose on Tuesday after the Department of Labor reported that the U.S. economy added 148,000 jobs in September, well below expectations for an increase of 180,000.

The unemployment rate ticked down to a four-and-a-half year low of 7.2% from 7.3% in August due in part to more people dropping out of the labor force, which also weighed on the greenback.

The disappointing data fueled expectations for the Federal Reserve to continue stimulating the economy to boost job creation by buying bonds each month.

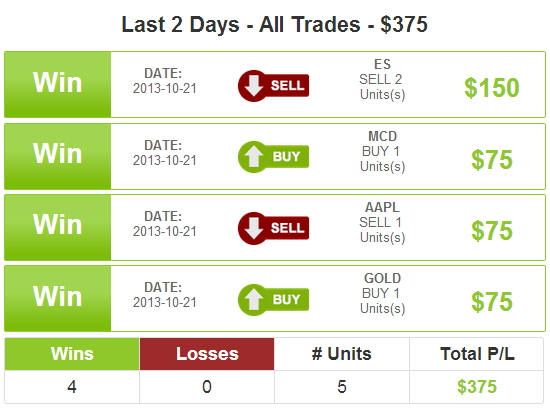

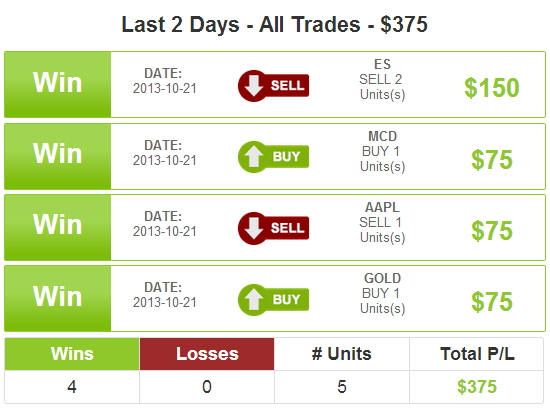

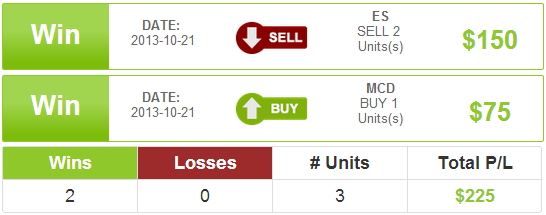

4-0. That's our trading record this week for our GOLD alerts. Just in case your math is fuzzy, thats 100%, and 375% in profits has poured into our accounts.

If you aren't cashing in on our profitable alerts, you need to start immediately. We are offering 3 months of FREE GOLD Alerts for depositing at any of our partner Trading Brokers, and 5 months FREE for a new AnyOption account.

AnyOption Summary

Deposit Options:

Credit Card

Minimum Deposit: 0

Maximum Deposit: ,000

Deposit Bonus: 50% up to 00

|

.jpg)

.jpg)

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips