It's not often we come across a female trader, an unfortunate

reality, but when we do, we love to post about them. Check

out Lorenoem, who

openly partner trades with her husband, and boy do they cash

in!

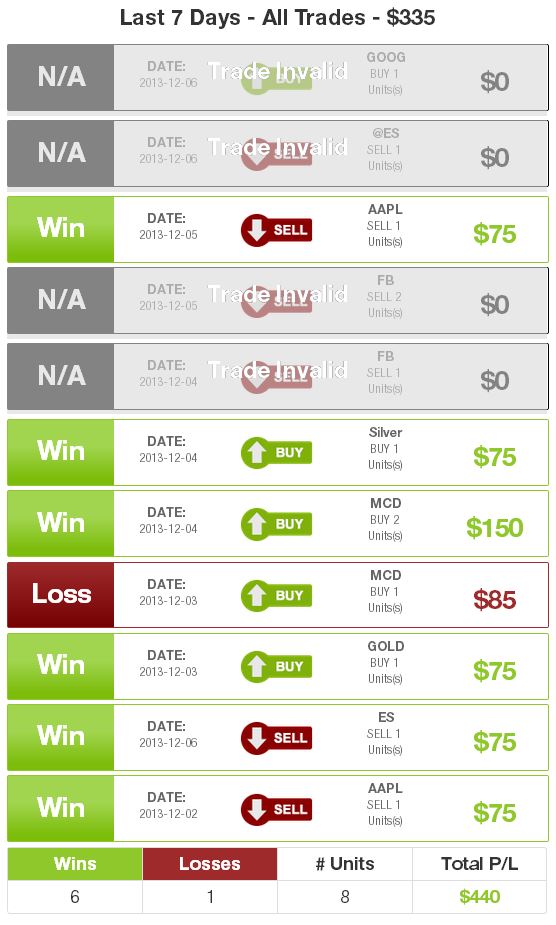

So far Lorenoem has Cracked 493% profit in the last 6 months

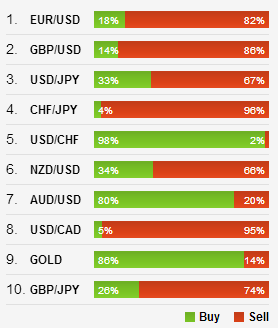

on eToro CopyTrader! Using mostly currencies with a

few commodities sprinkled in, these profits have come about from

trading primarily LOW and MEDIUM risk trades.

Check out the video, and start copying Lorenoem now!

Check Out Her Profile

& Copy Her Trades

Broker of the Month

GTOption - IT's Broker of the Month

Our friends at GTOptions.com have come to us at

IntelliTraders.com with some of the biggest and baddest bonuses we

have ever seen in the Binary Options world. GTOptions.com boasts

one of the most simple to use trading platforms, an expansive asset

index that allows trading on over 80% of IntelliTraders.com alerts,

and most importantly, deposit bonuses for all new traders to give

them a starting bankroll that mirrors the big money traders.

Create and fund a new GTOptions account and receive the

following:

- 100% Deposit Bonus: That’s

right, GTOptions will immediately and automatically

match your deposit amount up to 0. In other words, deposit 0,

trade with 0. Deposit 0, you now have ,000 to trade

with!

-

- One GUARANTEED Winning Trade: If our IT

daily alert loses we will instantly refund your losses up to 0.

This is literally a can’t lose proposition.

-

- 3 Months GOLD Alerts FREE: Fund a new

GTOptions account and we will upgrade your IT account to GOLD

status, giving you 3-5 free alerts every single trade day to profit

with. This is normally a 9 value, but yours free with a new

account!

If you are looking for a new broker, or are new to

trading all together, don’t miss out on these incredible bonuses

from GTOption!

.png)

.jpg)

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips