Broker of the Month

TopOption - IT's Newest Partner Broker

TopOption.com is at the top of our rankings of all of our partner brokers, and with good reason. With a 0 minimum deposit, an easy to use trading platform with many expiration options, and a huge asset index, we at IntelliTraders.com recommend every one of our traders to get a TopOption.com account of their own. In fact, we will pay you to do it. Create and fund a new TopOption.com account and receive the following:

- One GUARANTEED winning trade – if our free alert loses we will refund your losses up to 0!

- 3 months GOLD alerts FREE – you will receive a minimum of TWO daily GOLD alerts free (a 9 value)

Don’t waste any more time wondering what broker you should start your trading career with – it’sTopOption.com and we will pay you to do it. Let’s go!

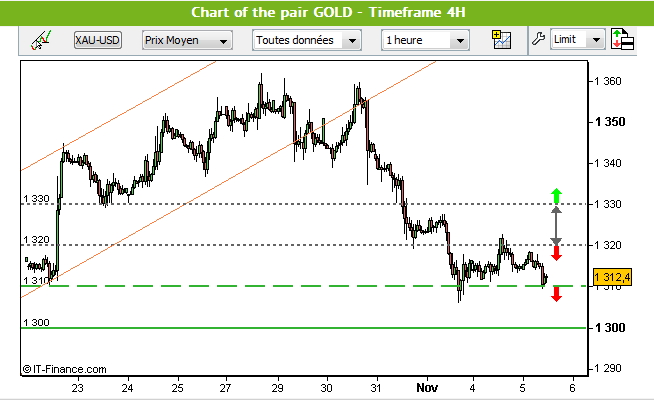

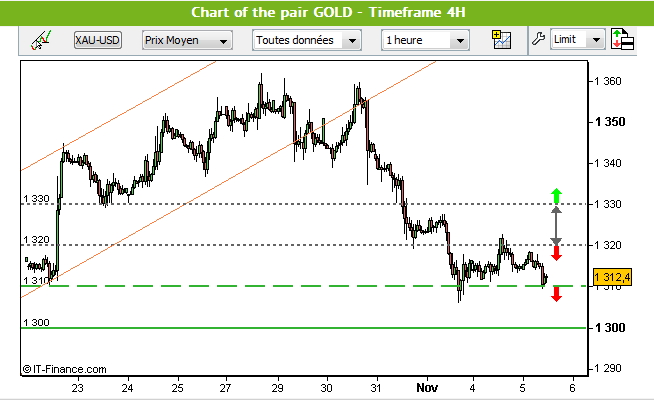

The Gold (XAU/USD) made a triple top on 1360 points before to start a bearish rally.

The price has stopped its movement on the support at 1310 points.

A quick pullback on 1320 points has been made yesterday but 1310 points is again tested this morning.

I would advise traders to trade only Shorts positions (sell) as far as the price is below 1320 points.

A break of 1310 points will provide a new sell signal for a return on 1300 points.

In case of return above 1320 points, i would then advise traders to wait for a breakout of 1330 points before to trade long positions (buy).

U.S. stocks rose on Wednesday on sentiments that the October jobs report due out on Friday won't come in strong enough to prompt the Federal Reserve to consider winding down stimulus measures.

At the close of U.S. trading, the Dow Jones Industrial Average finished up 0.82% at a record-high 15,746.88, the S&P 500 index rose 0.43%, while the Nasdaq Composite index fell 0.20%.

Stocks rose despite an relative lack of market-moving news on Wednesday, mainly due to expectations that Friday's October jobs report will reveal modest improvements taking place in the labor market though not enough to convince the Fed to begin tapering stimulus programs.

Extraordinary accommodative policy tools such as the Fed's USD85 billion in monthly bond purchases drive down borrowing costs to spur recovery, boosting stock prices in the process.

The Federal Reserve has said it will pay close attention to economic indicators before deciding when to taper the pace of its monthly asset purchases, and in recent weeks, economic indicators have painted a picture of a U.S. economy moving along the road to recovery though still in need of a monetary crutch from the Fed.

Analysts are predicting the Labor Department to reveal the U.S. economy added a modest 125,000 nonfarm payrolls in October.

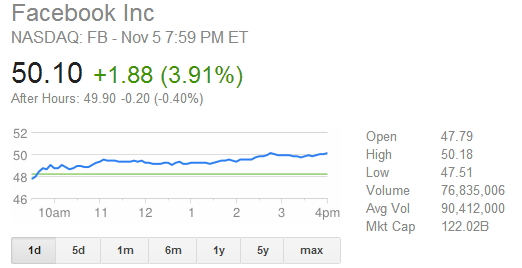

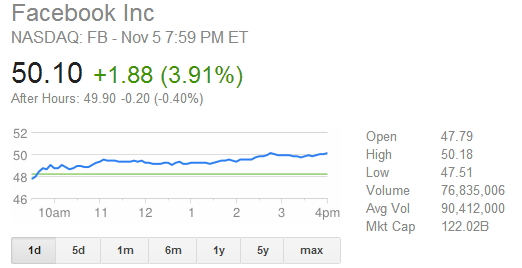

Tuesday's alert to purchase a BUY/CALL on Facebook (FB) was a perfectly timed alert with FB closing the day over 3% above our entry price. Check out the chart below - you'll notice just a smooth trend upward throughout the day, giving us a worry-free 75% return on the trade.

.jpg)

.jpg)

Register For...

Free Trade Alerts

Education

1-on-1 Support

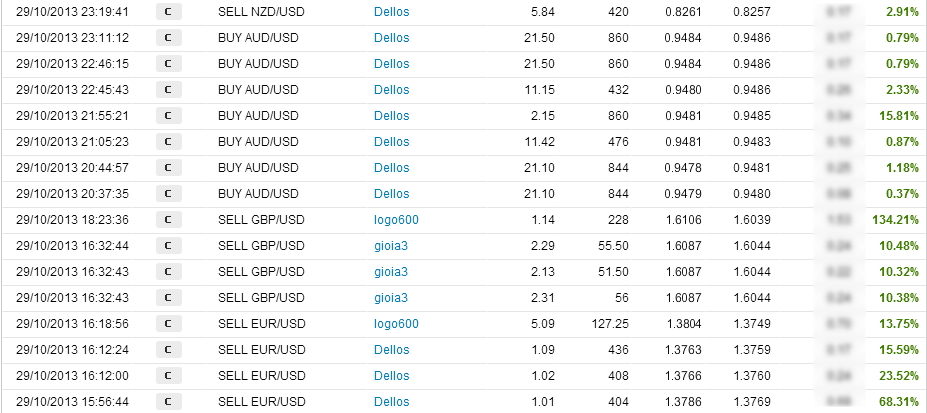

eToro Copytrader Tips